Outstanding Npv Template Spreadsheet

Enter the investment amount discount rate and cash flow projection in the green cells.

Npv template spreadsheet. The concepts serves as the basis for the Net Present Value Rule which. The rate arguments that are supplied to the function are stored in cell C11 and the value arguments have been stored in cells C5-C9 of the spreadsheet. Net present value is used in capital budgeting and investment planning so that the profitability of a project or investment can be analyzed.

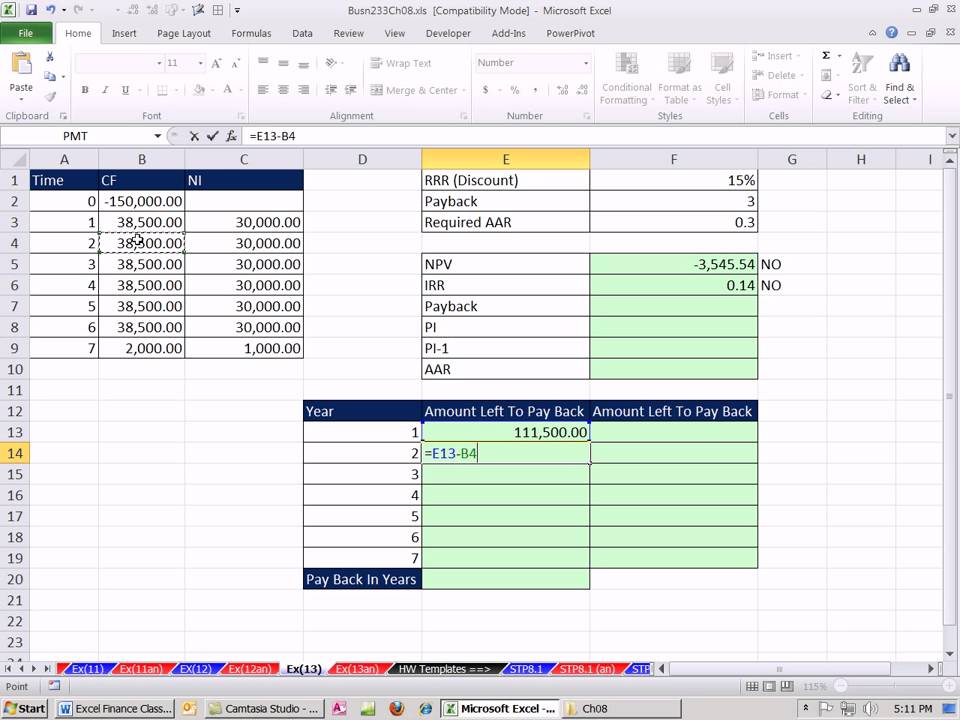

Lets find out how to calculate NPV in Excel. The correct NPV formula in Excel uses the NPV function to calculate the present value of a series of future cash flows and subtracts the initial investment. Click cell B10 and enter the function.

Input all information related to future cash flows on the Data Entry worksheet. For example project X requires an initial investment of 100 cell B5. NPV formula in Excel.

I have reviewed your template about NPV calculation but I have a concern whether your understanding of this formula was correct. In addition to explaining how to calculate NPV and IRR you can download a Free Excel NPV Calculator to help you see how to set up your own financial analysis spreadsheet. Net Present Value NPV is the value of all future cash flows Statement of Cash Flows The Statement of Cash Flows also referred to as the cash flow statement is one of the three key financial statements that report the cash positive and negative over the entire life of an investment discounted to the present.

Formula for calculating NPV in Excel is little tricky. The downloadable spreadsheet template contains two worksheets. Net Present Value Understanding the NPV function.

It also helps to compare with different investment options and to easily decide whether to introduce the new product. This is important because it factors in the time value of money and the associated interest and opportunity costs. The Executive Summary worksheet shows the NPV IRR and other metrics.