Heartwarming Sez Invoice Format Under Gst In Excel

It enables the supplier to collect payment from the buyer as well as claim ITC under the GST Law.

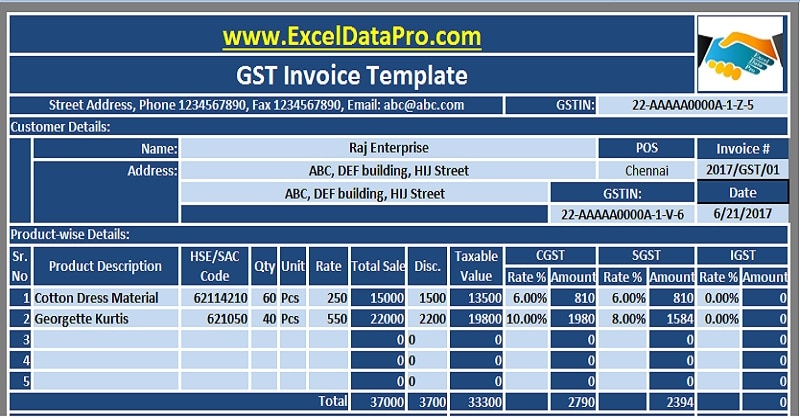

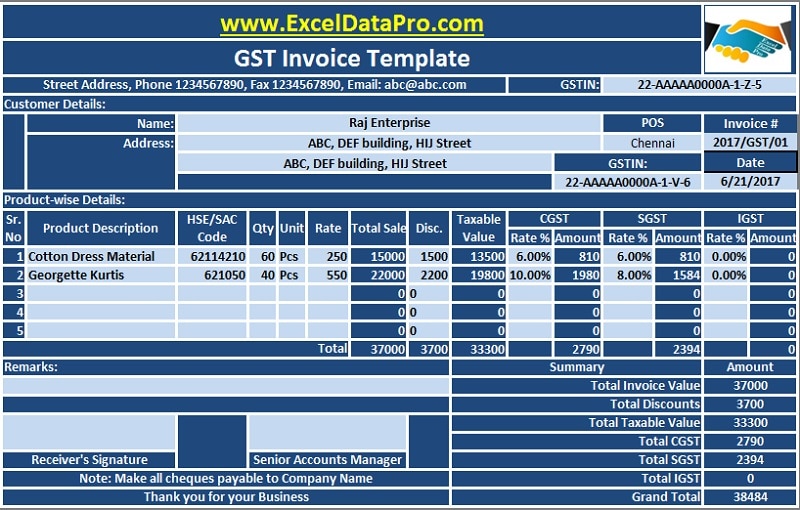

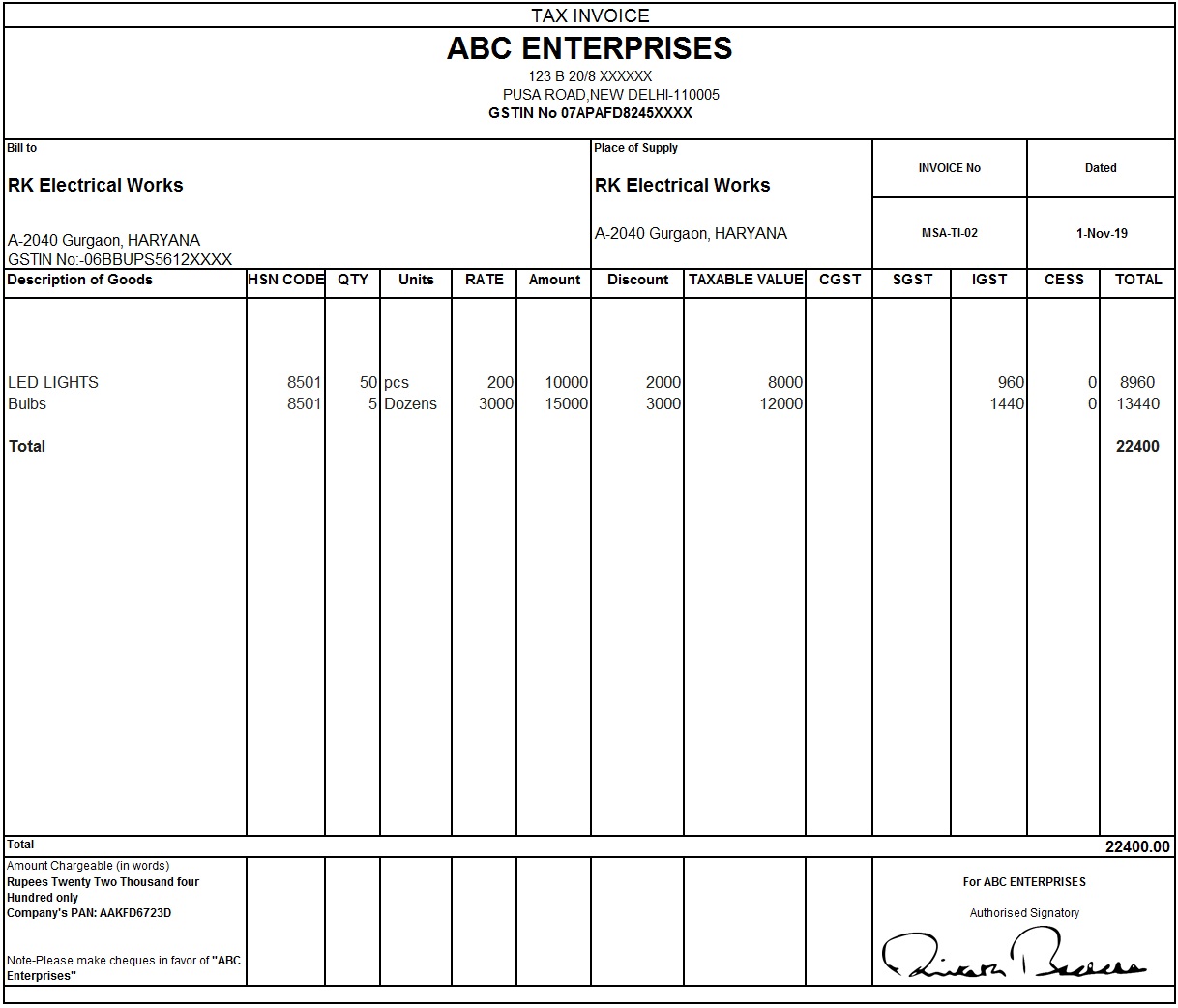

Sez invoice format under gst in excel. Most businesses that deal under GST already know the invoice format requirements but some questions arise when they do business with foreign clients with the place of supply outside of India. Tax invoice is nothing but a proof of sale that contains the details with regards to the goods or services supplied quantity or value of such goods or services tax charged etc. Shared details about Section 164 of the Central Goods and Services Tax Act 2017 12 of 2017.

Grace Period for E-invoice Under GST of 30 Days has been granted by CIBIC. Thus GSTR 1 format in excel plays a very important role for filing return under Goods and service tax in India. 25 E-invoicing System under GST The move will help in curbing Goods and Services Tax GST evasion through issue of fake invoices.

Sample View of e-Invoice Format. Is there any specific format for invoice to be issue to SEZ or any section of rule that mentions about mentioning not mentioning IGST. Informed about the implementation of Dynamic QR Code on B2C invoices deferred to December 01 2020.

The profile can be altered in future if needed. The GST portal initially released two types of e-invoice templates. Section 31 of the CGST Act 2017 mandates every registered person supplying goods or services to issue a tax invoice.

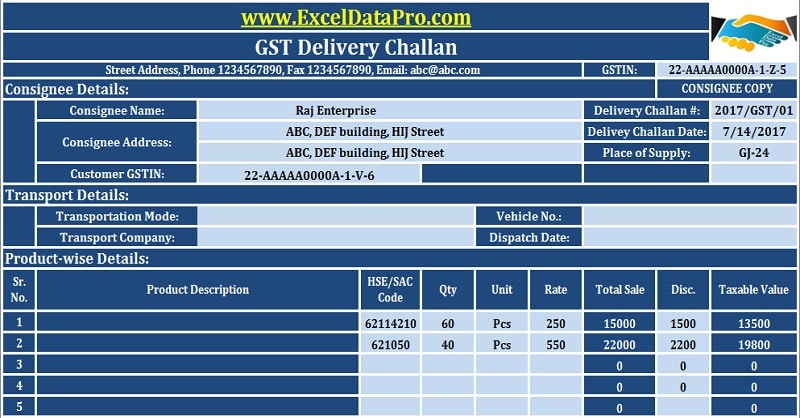

Read on to know more about GST and EWB implications on SEZs. GST Sales - Nil Rated Exempt SEZ Other Territory Deemed Export Consumer Consignee Sales and Works Contract Once you activate GST in your company you can record a variety of sales transactions outward supply such as sales to other territory and SEZ sales to foreign tourists nil rated and exempt sales deemed export and so on using a sales voucher. Profile of more than one GSTIN can be added in the offline tool for matching or to see GSTR-2B.

Once GSTIN is entered the system sends an OTP to his registered mobile number registered with GST Portal and after authenticating the same the system enables him to generate hisher username and password for the E-invoice system. NormalSEZ DeveloperSEZ unitcasual taxpayer. Special Economic Zone SEZ developer or Special Economic Zone unit is considered to be an Inter state supply and Integrated Goods and Service tax IGST will be applicable.